Residential Solar Incentives – What is Available?

Most Americans are supportive of increasing our energy independence, reducing our reliance on fossil fuels, and using renewable energy sources. With the current array of incentives being offered, there has never been a better time to make the switch to solar energy.

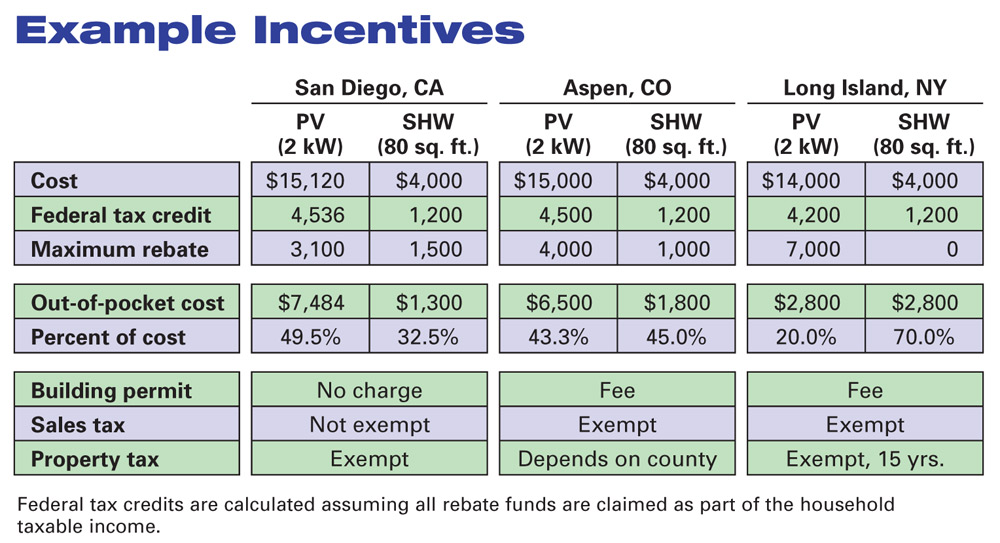

Today there are tax credits, rebates, and other incentives available to those who choose to join the renewable energy movement and install solar energy panels. These incentives are available through Federal, State, and local government entities and can lower the cost of a solar energy system by up to 50%. By capitalizing on these incentives rebates, a solar energy system can quickly pay for itself.

Residential tax incentives come in many forms including Federal and State income tax credits or deductions, sales tax rebates, and property tax credits. These can all be used to reduce the up-front costs of purchasing a solar energy system.

-From Homepower.com

Federal Tax Incentives

The Residential Renewable Energy Tax Credit, which stems from The Energy Policy Act of 2005 and subsequent renewals, allows a taxpayer to claim an Investment Tax Credit of up to 30% of qualified expenses for purchase of a solar energy system (as well as other renewable energy systems) for a home they use as a residence that is located within the United States. Generally, for incentive purposes, the expense is considered to be incurred once the installation has been completed. Qualified expenses can include:

- Labor costs for site preparation

- System installation (both materials and labor)

- Wiring

As systems can cost in the tens of thousands of dollars, if the Federal tax credit exceeds the taxpayer’s liability, the remaining credit can be carried forward to the next tax year. This can continue until the credit has been fully used or until the 2016 tax year whichever is sooner. At this time it is not clear if this program will be extended beyond December 31, 2016. President Obama has indicated that it will not.

State Programs

Many States also have income tax incentives, sales tax rebates, and other cash rebates available to those purchasing a solar energy system. The amount of money available varies from state to state. One of the best sites to visit to view those programs can be found here. Remember, incentives are generally provided to encourage early adopters to make the switch to solar power. Many of these programs are being cancelled as allotted funds are used and may not be available as long as the Federal incentives are in place. They may also have different rules regarding tax carry-over provisions. Generally speaking, the faster you act, the better your chances are at securing state fund or incentives to help pay for your investment.

Local Programs

Check with your county Assessor about property tax incentives and your local utility company about any rebate plans they have available. Surprisingly, many utilities have incentive programs or rebates available.

Don’t forget to ask

Navigating the tax and rebate programs can be a daunting task; ask the company you are purchasing from for assistance. Some companies will even credit your account for the Federal 30% up front; check to see if the company you have selected offers that benefit. National Solar Project can help connect you with local installers who can offer free quotes.

In addition, remember that tax laws change often and can be tricky. Always consult your acco

untant, attorney, or tax adviser for up to date information.

CLICK HERE TO LEARN HOW MUCH YOU CAN SAVE WITH SOLAR – IT ONLY TAKES 30 SECONDS.