The Cost of Solar Panels For Your Home

I want Solar Panels – How Do I Pay for Them?

Solar installations are no different. With the rising cost of electricity and the seemingly monopolistic relationship many have with current providers, it’s now small wonder that cost savings is the top reason homeowners across the country are going solar. Not only can you save major money, and increase your homes value, you also free yourself from being hostage to your utility provider and its rates. Like all major purchases in life we have to figure out where the money is going to come from in order to buy what we want. Some call it a budget, some call it a spending plan, either way you have options when it comes to putting solar on your home.

If you have the cash (tens of thousands of dollars) to cover the purchase and installation of solar panels, and you aren’t interested in tax incentives, you can simply write the check and forego reading the rest of this article. However, if like the majority of home-owners, you need some help with the financing here’s a few ideas.

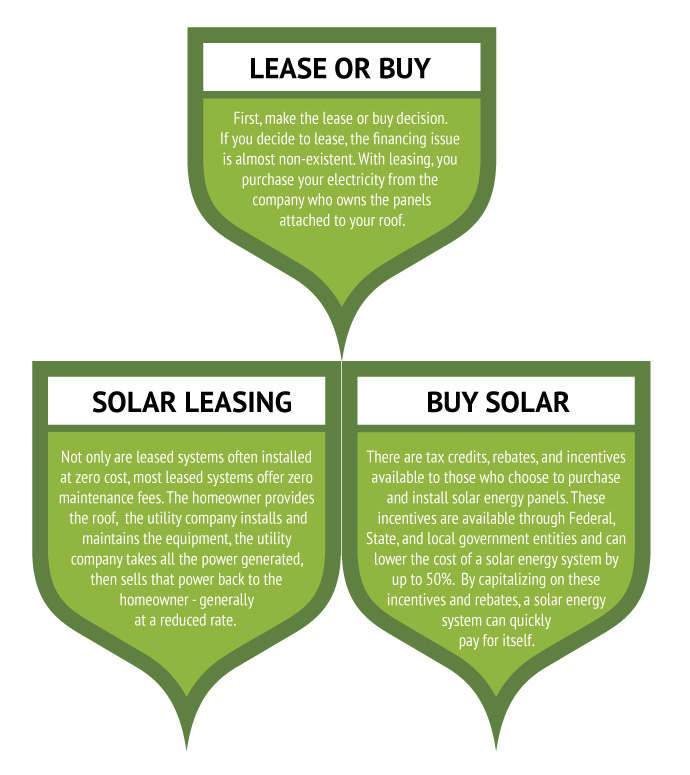

First, make the lease or buy decision. If you decide to lease, the financing issue is almost non-existent. With leasing, you purchase your electricity from the company who owns the panels attached to your roof.

Not only are leased systems installed at a very nominal price (often at zero cost), most leased systems offer zero maintenance fees. With a lease option the homeowner provides the roof, the utility company installs and maintains the equipment, the utility company takes all the power generated, then sells that power back to the homeowner through a monthly utility bill – albeit generally at a reduced rate.

Leasing provides the doing good for the environment feeling and saves a bit on the utility costs. No (or minimal) up-front costs also means minimal savings. If you are looking for a bigger return on your investment, purchasing a solar system may be what you are looking for.

Today there are tax credits, rebates, and other incentives available to those who choose to join the renewable energy movement and purchase and install solar energy panels. These incentives are available through Federal, State, and local government entities and can lower the cost of a solar energy system by up to 50%. By capitalizing on these incentives rebates, a solar energy system can quickly pay for itself.

Residential tax incentives come in many forms including Federal and State income tax credits or deductions, sales tax rebates, and local property tax credits. These can all be used to reduce the up-front costs of purchasing a solar energy system.

While the tax incentives are nice, the money to purchase the system usually comes out of the consumer’s pocket. To help with that, some solar companies will credit your account for the federal incentive up front – don’t forget to ask your provider about this. And for the rest of the money, consider a home equity loan to pay the remainder of the costs. A home equity loan gives you additional tax benefits over paying on a credit card. If you don’t have sufficient equity in your home, try a home improvement loan or financing through the company you are purchasing the system through. Even though the up-front costs can be a huge chunk of cash, the rewards of cheap electricity can help you see a return on your investment quickly.

Remember that tax laws change often. Always consult your accountant, attorney, or tax advisor for up to date information prior to making a purchasing decision based on possible rebates or tax credits.

Interested in learning how much you can save with solar? Click here to get a free quote and have all your questions answered for free.